A new way to grow a network

Introducing Participate-to-Earn and Stakers via Axie Infinity and Yield Guild Games

Howdy y’all 🤠! A quick prelude to say thanks. Thanks for taking the time to read these and share feedback. Thanks for responding with thoughts/reactions or hopping on a call to discuss (it’s been so gratifying to reconnect over shared interests).

And a HUGE thanks to everyone that’s shared the newsletter with others. Writing these takes a fair bit of time, but I’ve now met a friend of a friend that I hadn’t previously know via them subscribing and sharing thoughts on my last post, and I just think that’s really damn cool. So if you’re enjoying these and think your friends might too, consider sharing on LinkedIn or Twitter! 🙏

Lastly, if you’re reading these, enjoying them, and aren’t already subscribed, drop your email below and then you’ll be sure to never miss one 👇

My last two posts were primarily learnings from my Setter journey. This, post #3, will be a bit different. This one will be a thought piece about how crypto enhances network building.

I’ve participated in crypto in some way for quite some time now. In fact, I still remember wiring several thousand dollars to a bizarre name at a Japanese bank when depositing funds on Kraken in 2012 or 13. It took about a month for the funds to show up and I was therefore quite sure I had been duped. It turns out I wasn’t, but I eventually did get scammed out of several thousands dollars equivalent sometime later in the QuadrigaCX scandal.

Now although I’ve found it interesting for a long time, I’ve often found that fully wrapping my head around crypto’s potential and value proposition can sometimes be a bit of a head scratcher. But these past months in what’s been coined “NFT Summer”, one aspect of crypto has, if it wasn’t already, become crystal clear : Crypto unleashes the power of community to grow a network.

Again, it’s not unique to NFTs, it’s just that for the past decade, the industry has been hard at work building the largely unseen and unnoticed infrastructure layer. NFTs have moved crypto from fringe to mainstream. NFTs are a “crypto-bridges-to-real-life” (credits to Mike Silagadze on this framework) in the verticals of arts and entertainment (just wait until other verticals get bridged-to-RL!).

In this post we’ll look at Axie Infinity and Yield Guild Games as a couple specific and interesting case studies on the power of community and incentives to grow a network, and how the new concepts of Participate-to-Earn, and Stakers play into that.

NFT Summer

Backing up a bit. If you haven’t gone down the crypto rabbithole yet, you may be wondering ‘what the hell is NFT Summer’? So for those that haven’t been wasting copious amounts of time on Twitter 🤦♂️, here’s a few highlights :

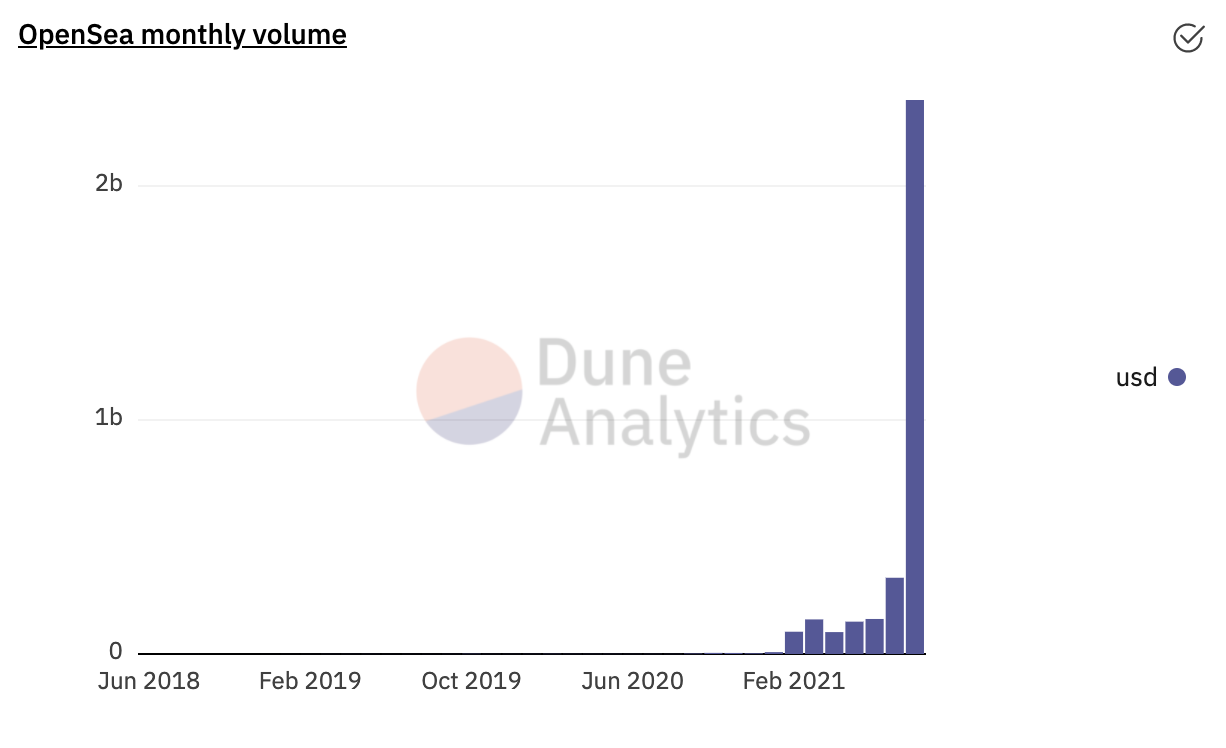

NFT sales top $2.5B in H121, and OpenSea, a leading NFT-trading platform, sees >$2bB of sales in first 27 days of August 2021 alone .. that’s double eBays’s monthly rev!

A squiggle (yes a squiggle!!) was sold for 750 ETH or ~$2.5M USD

Visa jumps into the game and buys CryptoPunk 7610 for equivalent of $150K

Budweiser also jumps in and pays ~$100K to secure it’s domain beer.eth on the Ethereum network (ps, I’ve locked in my altmbr.eth.. get yours before it’s gone!)

Gary Vaynerchuk buys CryptoPunk #2140 for ~$5M

Beeple’s “the first 5000 Days” was sold for ~$70M USD at a Christie’s auction

And, just for fun, a tweet that comments on the ridiculousness of the NFT flipping frenzy. I LOL’d.

So sufficed to say there’s some manic stuff happening in the world of flipping jpegs, and it’s a bit unclear at this point where this goes :

Is the bubble about to burst and everybody invested is about to lose a fortune?

Is what we’re seeing a land grab of NFTs that will actually be more valuable in the future?

The truth is likely a little of A and a little of B and will probably vary NFT by NFT.

What’s particularly notable about the rise of these NFTs is the fact that we’re seeing tons of communities pop up incentivized to hype their own NFT collection (e.g. there’s communities for each of : CryptoPunks, Bored Apes, Cool Cats, Degenerate Apes, Pudgy Penguins, Lazy Lions, etc etc.). You can bet that every CryptoPunk holder wants to see the value of CryptoPunks rise, so they’re all busy tweeting, getting articles published, and just generally building demand. There’s even communities within communities. For example, Packy recently bought a fractionalized CryptoPunk with 300 other folks via a PartyBid meaning that he and 300 other folks are now going to work together to hype up the value of that specific NFT within the CryptoPunk series.

Axie Infinity and Participate-to-Earn

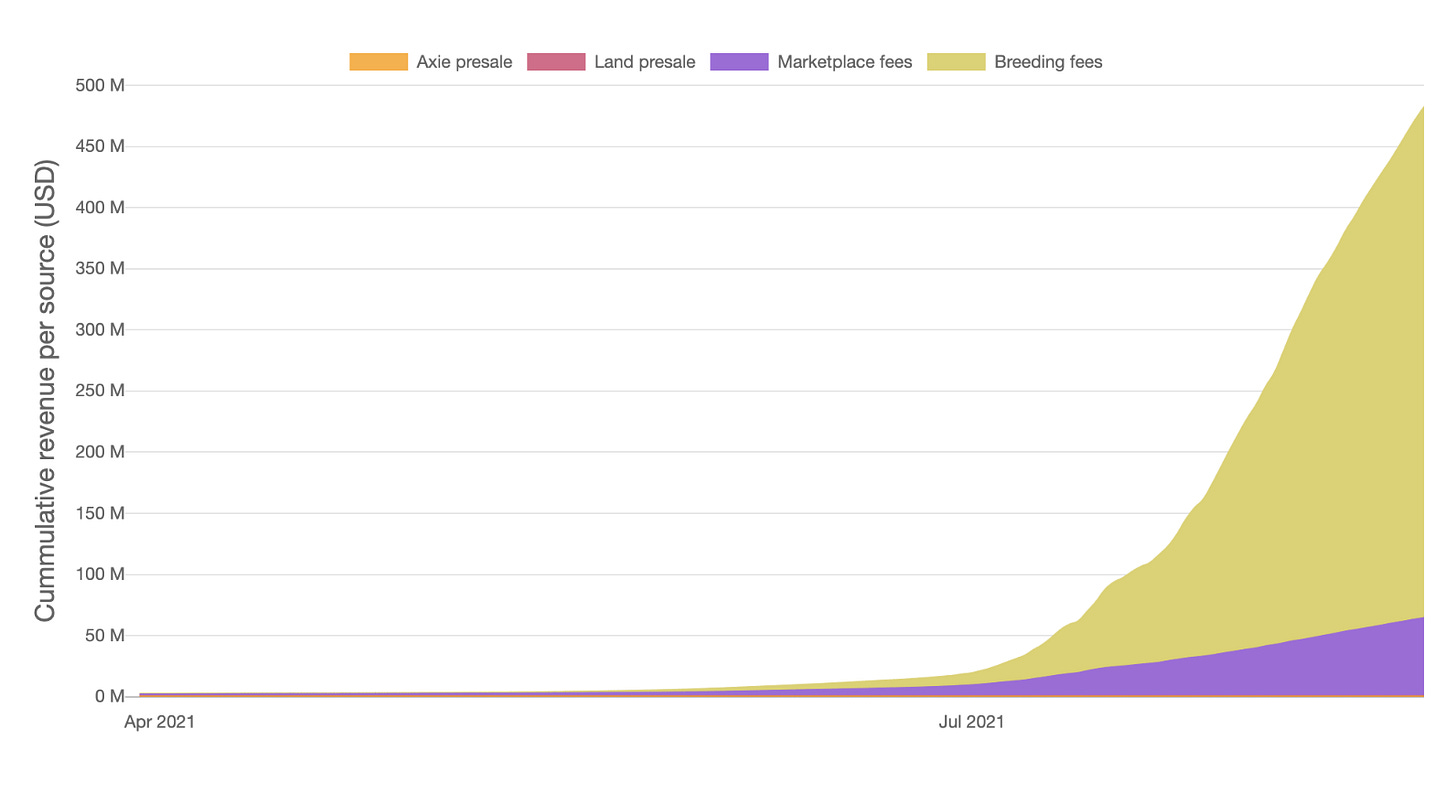

It’s this same dynamic of community-incentive-driven growth which is at play in the rise of Axie Infinity. Axie is a Pokemon-like game, that after launching it’s proprietary blockchain Ronin, achieved $450M of revenue at rates nearing the record-setters Ni No Kuni ($100M in <11-days) and Pokemon Go. Its governance token AXS is now (as at August 27th) valued at a $4.1B market cap.

In the case of Axie, they’re pioneering not just community-incentive driven growth but a specific novel concept called Play-to-Earn (later referred to in this post as PtE), whereby players earn / create real monetary value by playing the game. PtE is what has fuelled the game’s rapid rise, and a concept that I believe can and will be applied more broadly than just games but rather to all networks (e.g. what if Reddit or Wikipedia had a token that rewarded productive participation?). While it’s still unclear if Axie Infinity will have longevity (e.g. Star Atlas is another crypto/NFT based game that’s poised to come out soon and looks pretty cool), I do suspect Participate-to-Earn (PtE) is a concept that is here to stay and will have huge implications going forwards.

To understand PtE, we first need to understand how Axie Infinity works, and how it makes money. Gameplay is currently centered around battling your Axies with others. In order to start playing you need to buy at least 3 Axies, the cheapest of which are currently selling for ~$200 USD. So ~$600 for entry fee (=$200*3). As with most NFTs, some are worth a lot more than that minimum and according to their website as at Aug 24th, the largest single sale was for 300 ETH or ~$1M USD.

Part of the gameplay is leveraging your current Axies to breed more, which given Axies have real world value, is an income generating activity. To breed your Axies, you must have two Axies, pay an amount of AXS, and also some SLP. But the only way to get SLP, is to play the game. Hence PtE.

The game itself makes money in a couple ways :

Breeding fees. They charge 2AXS or ~$140 USD as at August 27th and some SLP to breed an Axie. As you can see in the purple/yellow chart above, this is their primary method of revenue generation.

Marketplace fees. They charge a 4.25% fee on any transactions made throughout the game (e.g. buying and selling Axies).

PtE is a novel approach because normally a network is launched with a limited set of levers that include : Sales, Marketing (SEO, SEM, PR, Local Event, Other Communities), Product Loops incl. Referrals, Word of Mouth, Piggybacking, and employing Supply (in case of a marketplace). PtE is a new tool in that arsenal.

An interesting by-product of PtE is that it creates new digitally native jobs. In the case of Axie Infinity, the potential earnings are rather limited. Most recently earnings from full-time playing has averaged about $200 USD / month. That’s not much for someone living in the United States, but can be much more if you’re living in an emerging economy. In the case of Axie Infinity, its timing has coincided with mass unemployment in the Philippines caused by particularly severe military enforced lockdown. As a result, the Philippines has emerged as a major cluster of PtE players, and now represents 60% of all Axie Inifinity user according to Packy McCormick in his article Infinity Revenue, Infinity Possibilities. If you’re curious, there’s a great 18-min video documentary called Play-To-Earn on subject.

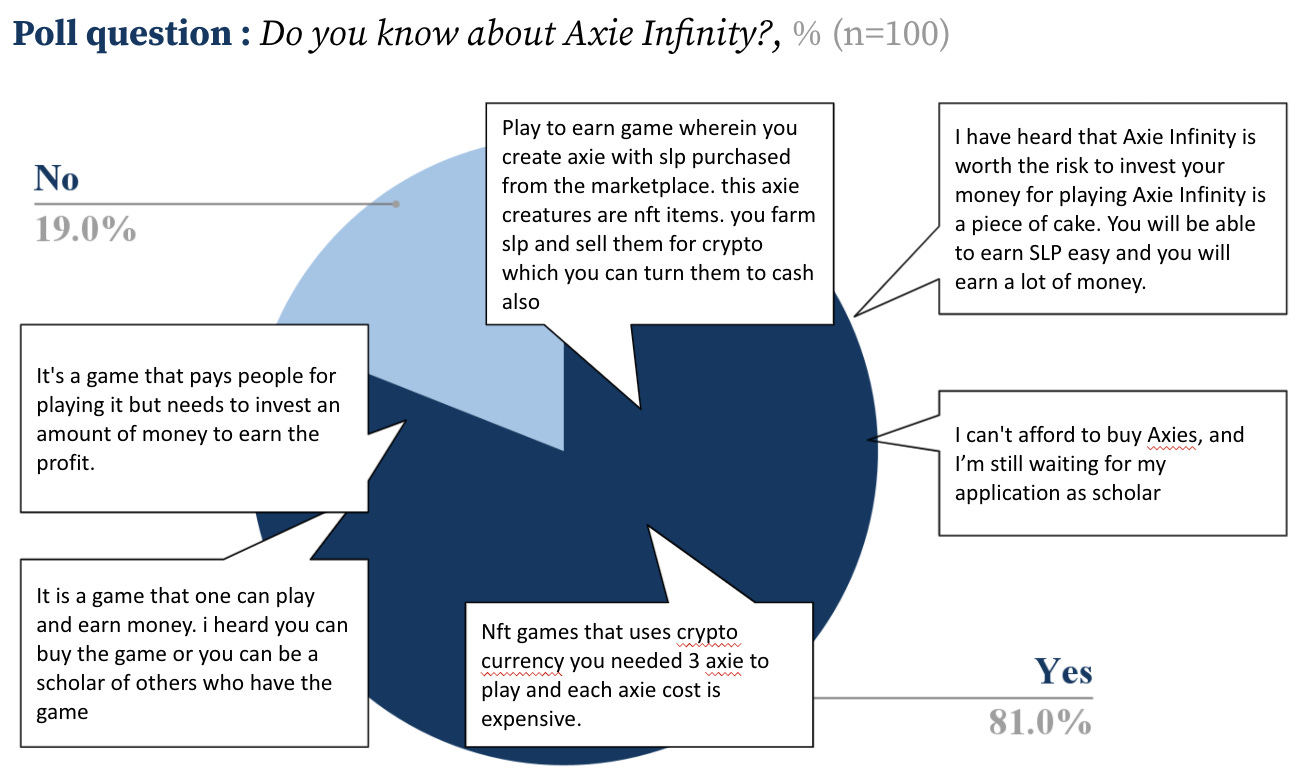

As someone that has a bit of a network in the Philippines, I thought I’d dig in and investigate a bit. Polling some colleagues there, I found that 50% (or 3 of 6) folks had already heard of the game. That’s wild for a game that really didn’t exist in a big way more than 3-months ago. Out of curiosity I took it a step further, and polled 100 people. Turns out 80% said they’d heard of Axie Infinity. Now, it is possible that both these figures are inflated because the educated folks I know, and the folks filling in Pollfish online are more likely to be informed of Axie. Irrelevant, the concept that anywhere near even ~50% of people learned about a game in < 3-months with minimal marketing spend is wild. Here’s the results of that poll :

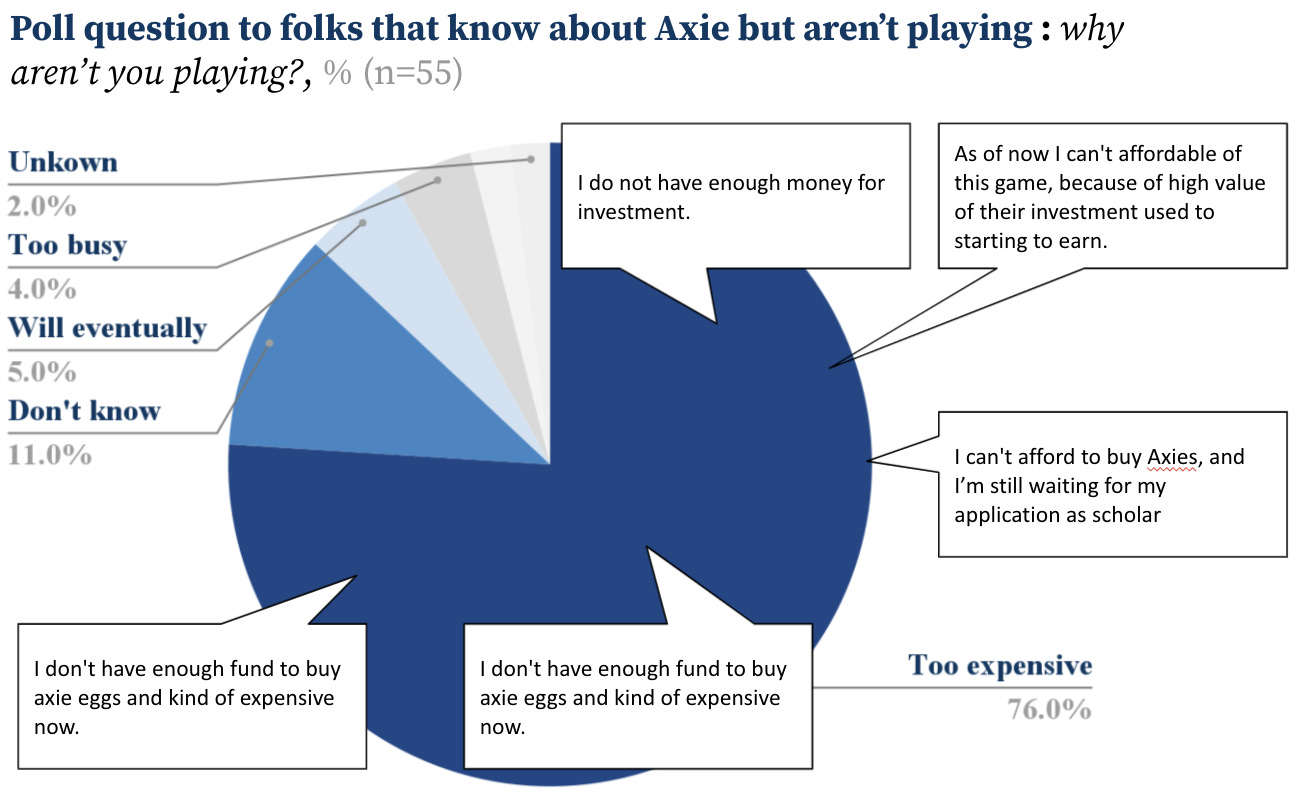

For those of the 100 folks that had heard of it and weren’t playing, I asked them why they weren’t engaging. 76% of those folks said they weren’t playing simply because it was too expensive. Makes sense. In order to start playing you need to buy 3 Axies (or ~$600 today). Enter Stakers.

Yield Guild Games and Stakers

A cluster of informal and more formal groups have emerged to buy the Axies, and loan them to folks so they can Play-to-Earn. One notable example is a decentralized autonomous organization (DAO) called Yield Guild Games (YGG) which recently raised $4.6M from a16z. Per their whitepaper, YGG is a DAO that spawned out of the Philippines, built to break the barrier to entry to PtE, and upon the belief that digital economies will someday be larger than real-world ones. As at Aug 19, YGG had 4,700 players that had earned a cumulative $8.6M! Wild!

Well that’s all for this post.

In summary, crypto has fascinating potential to dramatically speed up network development by leveraging community incentives. The base level incentive is token ownership and the resulting desire to increase token value. That’s what we’re seeing in NFTs. Beyond token incentives, we’re now seeing the emergence of PtE as a way to bootstrap a network. PtE is definitely applicable to multiplayer games like Axie where part of the value is in having folks to play against, and will likely be more broadly applicable too (e.g. imagine a Wikipedia or Reddit token that rewards content curation). Finally, in the case where there’s a prohibitively expensive buy-in cost to PtE, we see the emergence of Stakers like YGG. It’s a brave new world out there folks!

Ok so this was a bit of a different article and would therefore particularly apprecaite your feedback on this one. Loved it😍 , it was OK 🤷, it was boring 🥱.

As always, you can also reach me at altmbr@gmail.com, or on twitter @AltmanBryan. Also if you like this post and want to see others in your inbox 👇

Bryan

Also, if you’re curious to see the raw poll data. Linking it here.